Accounting software is essential for businesses to manage their everyday company operations. It enables corporate executives to monitor the financial health of their organisation. This is thanks to some of the basic features provided by all types of accounting software and systems, i.e:

1) General Ledger (GL) and Sub ledger

The general ledger may now be automatically populated with both journal entries and automated sub ledger entries, giving CFOs and controllers a real-time view of their financial data.

2) Accounts Payable (AR) and Accounts Receivable (AR)

Beyond simple accounting, a full accounting software system does other tasks. Organisations benefit from less record duplication, improved forecasting and budgeting, and comprehensive and appropriately categorised spending management. Additionally, it offers easy connection into financial systems, permits more precise audits, and maintains thorough monitoring records of any and all liabilities and assets.

3) Cash Management

Accounting software’s cash management features automatically match up cash transactions with bank statements to provide correct cash positions. With systematic cash available to review on payables, receivables, payroll sub ledgers, and external transactions, these capabilities also allow businesses to make timely choices about borrowing, investing, and other cash-related activities.

4) Asset Management

You can manage the complete asset life cycle, including purchase, capitalisation, depreciation, and retirement, with the use of a contemporary accounting system. Having total visibility makes it easier for firms to produce accurate financial accounts for appreciation and depreciation.

5) Risk Management and Compliance

Accounting software that includes security, risk management, and audit controls as standard features is an organisation’s greatest line of defence against fraud and unauthorised user access. These internal controls and the division of labour provide your business a safe, single source of truth for data while also assisting you in staying in compliance with any applicable laws.

6) Collections Management

An essential accounting software feature is managing customer collections. It is simpler to rank clients, set collection plans, handle collection payments, and start late-stage collections for bankrupt customers with full collections management.

7) Revenue Management

Accounting software with integrated revenue management features automates the process of applying analytics to increase revenue and profitability.

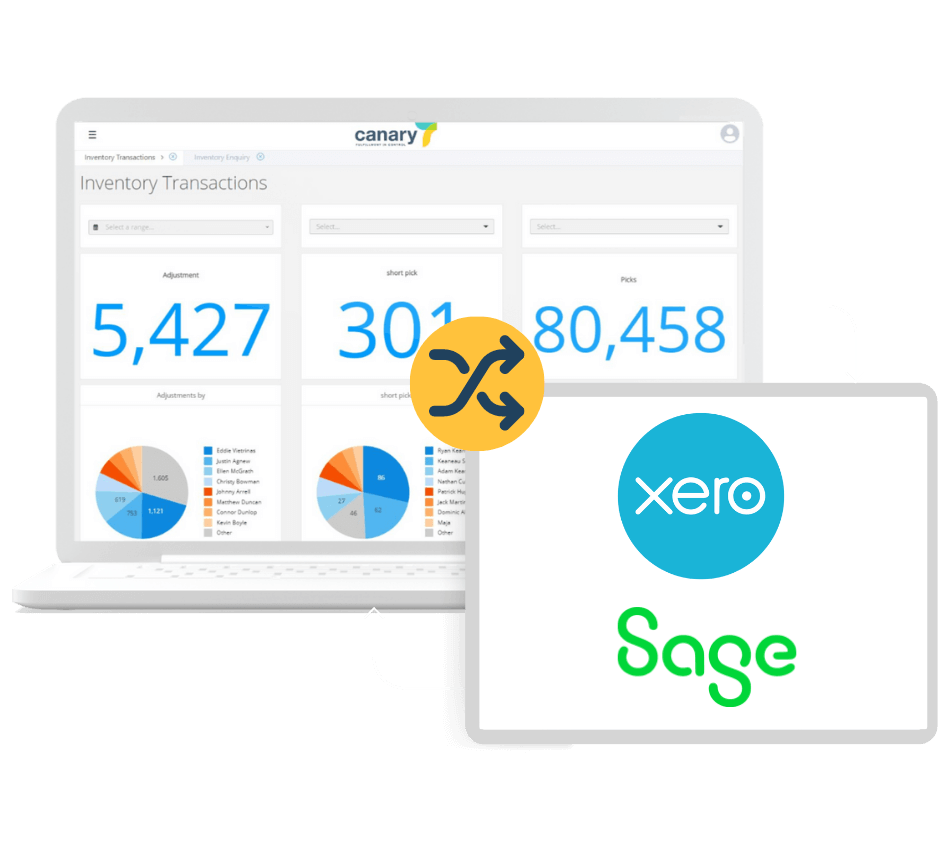

8) Reporting and Analytics

A comprehensive accounting system contains features for reporting and analytics in addition to the ability to record financial transactions. These pre-built dashboards assist finance professionals in understanding the financial health of their company and drilling down for more specific data. These dashboards track crucial financial metrics in real time, including inventory turnover, net working capital, quick ratio, debt-to-equity ratio, and current ratio, to mention a few.